Walmart’s retail media network: What advertisers need to know

As Walmart’s dominant physical footprint runs toward digital, it’s crucial to pay attention to the opportunities available to advertisers.

Think back to that old cutout of Hulk Hogan standing at the edge of your childhood supermarket aisle hawking chips. Retail media is like that but on the web.

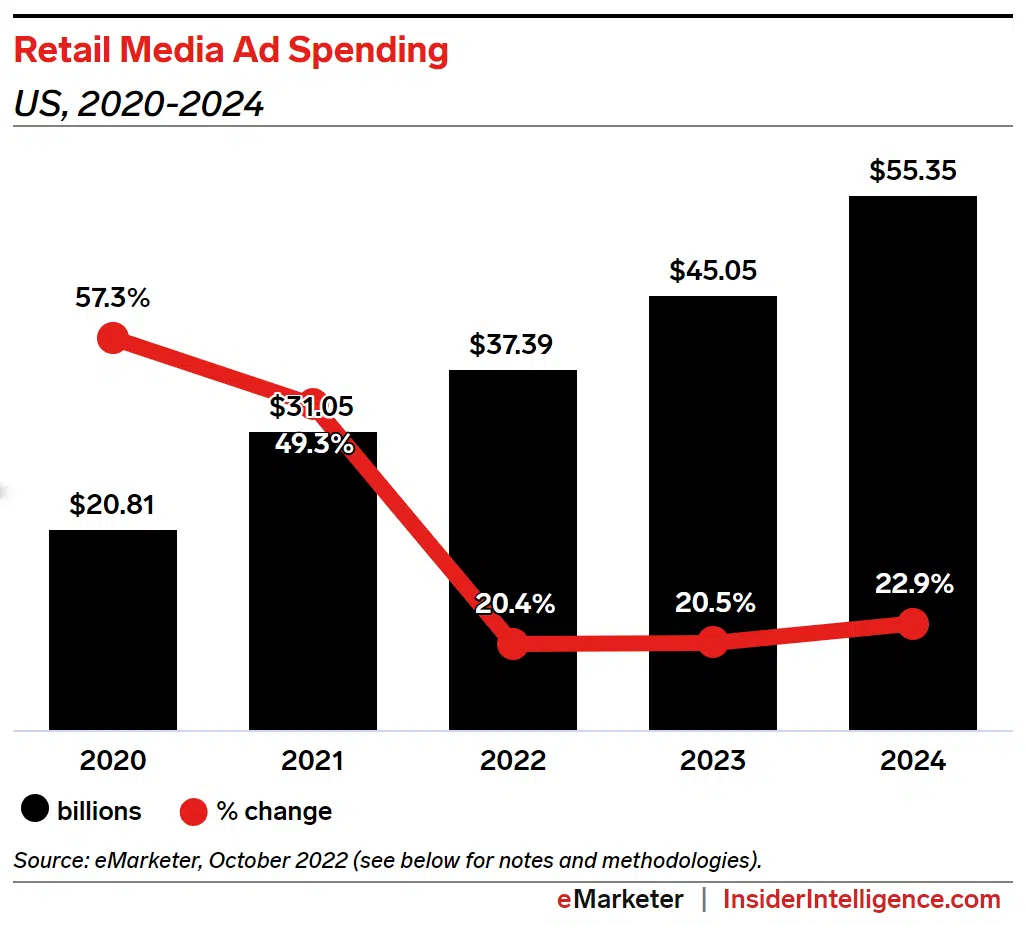

With retail media ad spending on pace to grow over 20% in 2023 to upwards of $45 billion, it’s no surprise that retailers of all shapes and sizes are running for a piece of the pie.

That pie is growing bigger by the minute given the industries’ growing need for first-party data and corresponding retail-specific ad opportunities, which are constantly evolving. Let’s not forget, COVID happened and completely upended consumers’ approach to retail.

Ecommerce demand has continued to grow, albeit at a slower pace post-pandemic. But what’s also growing is consumers’ need for a more flexible and personal shopping experience beyond digital.

Consumers’ growing need for flexible fulfillment solutions

With Amazon being in the number one spot of top U.S. companies by ecommerce share (~38%), suffice it to say they have got digital down and cornered.

But Amazon lacks physical retail locations – which just so happen to be essential for the growing popularity of flexible fulfillment solutions, such as buy online, pick up in-store (BOPIS), click and collect (C&C), curbside pickup, and more.

What Amazon lacks, Walmart – its closest competitor in the digital space – has in droves. The retail giant’s 4,700+ physical retail locations helped cement them as the largest U.S. retailer.

Physical locations aside, Walmart has a strong and growing digital offering. It is ranked second in the U.S. for ecommerce share, heavily driven by its dominant digital grocery performance.

Interestingly, grocery is a category rarely seen in digital pre-2019 but is quickly expanding in connection with solution advancements and consumer needs.

This combination of dominant physical reach with a growing digital powerhouse truly positions Walmart as a differentiated solution with rapidly expanding opportunities.

Walmart’s current ad offerings

Although Walmart is playing a bit of catch-up on platform sophistication and ad opportunities compared to industry peers like Amazon and Google, they are doing it at an incredible pace.

Before 2021, nearly all advertising efforts were managed by Walmart, except for their stand-alone self-serve search ad unit, sponsored products.

Jump a couple of short years ahead and they have expanded their search and display efforts aggressively, resulting in three new self-serve service lines with:

- Sponsored brands.

- Display self-serve (DSS).

- Walmart DSP.

Walmart still offers a managed service for first-party sellers with spend commitments and deep pocketbooks, but it’s clear to see their priority in opening advanced ad opportunities to a wider seller base.

Not to mention the numerous recent partnership announcements to facilitate expansion into social, live stream, CTV and other engaging ad opportunities.

Before we get ahead of ourselves and jump to what’s next, let’s look at Walmart’s current ad opportunities that sellers of all sizes can leverage to drive brand performance and relevancy on and off the platform.

Self-serve sponsored search

Sponsored products

Walmart’s core search offering, sponsored products let you leverage search terms and product data to serve ads against consumers’ search intent.

This ad unit generally captures consumers within the intent phase of the customer journey, given that the ads are served alongside organic placements within the search engine results page (SERP).

They commonly have digital-focused, return-based goals since this ad unit is closest to the point of purchase.

- Availability: First party and third party

- Funnel position: Intent

Sponsored brands

Sponsored brand ads are top-of-page search banner ads served against consumers’ search intent.

They are great for:

- Moving slightly up the funnel into brand-building tactics.

- Leveraging competitive tactics and category share improvements given the keyword targeting structure and top-of-page placement.

These PPC ad units contain a brand logo, which will lead to a shelf (sub-category) or search page, and up to three products, which will redirect to a product page.

- Availability: First party and third party

- Funnel position: Consideration, intent

Self-serve display

Walmart DSS (Onsite)

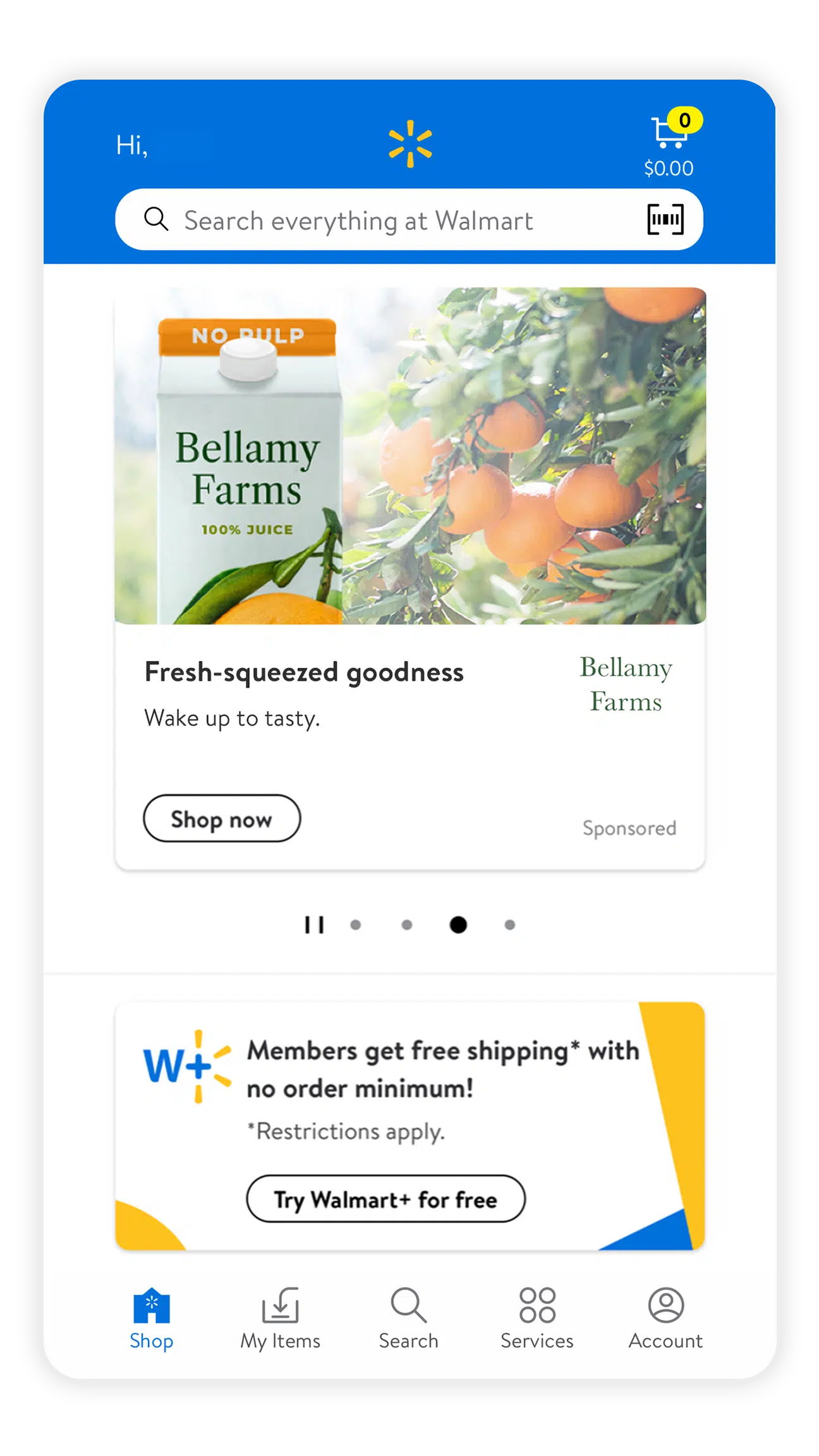

Walmart display self-serve (DSS) is a nimble, self-serve platform that gives advertisers control over their onsite Walmart display advertising efforts.

Within DSS, advertisers can leverage Walmart audiences to serve display assets to consumers across Walmart.com via numerous targeting tactics.

This platform comes with an automated creative builder and efficient campaign setup for agility at scale.

Additionally, the DSS platform includes digital and in-store performance reporting to better understand total impact.

- Availability: First party

- Funnel position: Awareness, consideration

Walmart DSP (Offsite)

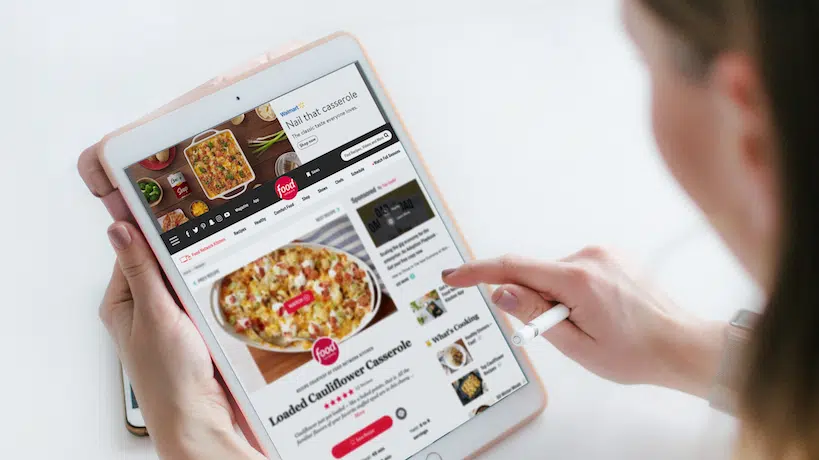

Walmart DSP is a demand-side platform that marries the power of The Trade Desk’s industry-leading technology with Walmart’s expansive omnichannel first-party data.

This leads to a differentiated offer that allows advertisers to leverage Walmart audiences to serve ads across The Trade Desk’s inventory across the open web.

With the added benefit of Walmart’s closed-loop reporting, sellers will have a clear view of the impact that their omnichannel ad efforts are having throughout all points of the customer journey, both on and offline.

- Availability: First party

- Funnel position: Awareness, consideration

What’s in store for Walmart advertisers and how to get ahead

As you can see from the above advancements, Walmart understands advertisers’ need for accessing and acting on first-party data at scale.

Recent social, live stream and video partnerships point to the retailer’s bid to serve consumers looking for more interactive and personal shopping experiences.

Ultimately, Walmart is laying the groundwork for advertisers to leverage their data within these new and engaging ad formats.

Given that the last update we received in this area was in mid-September of last year, I would anticipate further advancements in the coming months.

Don’t get me wrong – ad expansion is great but it’s only half the battle. Understanding the impact of those ads is just as important, if not more, both online and in-store.

Walmart has an uphill battle in this department given their high in-store and cash transaction rates. They are taking steps to close that gap, which includes the expansion of Walmart+.

Walmart+ has seen consistent growth and now accounts for up to 25% of total ecommerce sales, according to a recent study by Consumer Intelligence Research Partners (CIRP).

In addition, Walmart is also working to close the loop through programs like cashback rewards, in partnerships with solution providers like Ibotta. This is a major priority for brands across the board so I would expect this to be a focus within the coming year.

If you take anything from this piece remember this…

Walmart has the physical infrastructure to meet consumers’ evolving shopping needs and the pocketbook and roadmap to claw away at digital market share.

Their data is growing and so are the ways in which they are allowing advertisers to leverage it. Sure, they still have solution gaps, but they are not scared to try things and are aggressively working to close them.

Needless to say, I expect 2023 to be a year of evolution. Buckle in because the retail media race is on, and Walmart has a pole position.