Yext files for long-awaited $100 million IPO

Last year the company announced a revenue “run rate” of $100 million.

Yext has been on a path toward an IPO for quite some time. On Monday, the company filed an S-1 form with the SEC, seeking to raise $100 million.

Instead of as a “presence management” provider, the company is describing itself as a “knowledge engine,” hoping to tap into some of the mystique of search:

Yext is a knowledge engine. Our platform lets businesses manage their digital knowledge in the cloud and sync it to over 100 services …

We offer our cloud-based digital knowledge platform, the Yext Knowledge Engine, to customers on a subscription basis in several packages. Each package provides varying levels of access to our key Listings, Pages, Reviews and other features. Our Listings feature provides customers with control over their digital presence, including their location and other related attributes published on the most widely used third-party applications. Our Pages feature allows customers to establish landing pages on their own websites and to manage rich and compelling digital content on those sites, including calls to action.

Yext started life as a pay-per-call provider and then, seeking to emulate “Google Tags,” sought to create a similar system across a network of local sites. In building that network, which included Yahoo, Mapquest, Superpages, Citysearch and a number of others, Yext created a presence management differentiator: real-time updates.

It has been able to leverage that competitive advantage (until recently) and savvy marketing to elevate itself above the rest of the listings management crowd. Yext announced last year that it had reached a $100 million run rate.

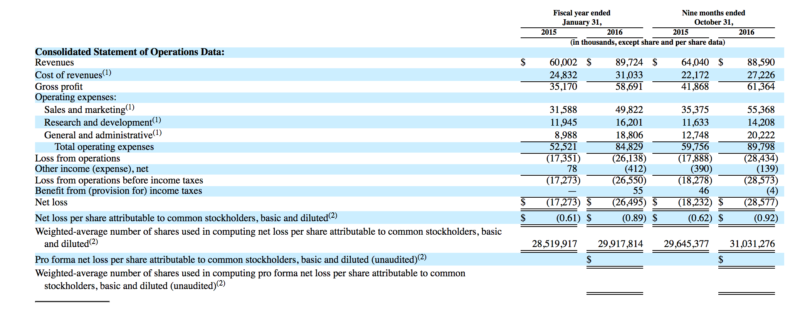

For the first nine months of 2016, the company had nearly $89 million in revenue and a $28 million loss. There’s no question that the service (digital presence management) has clear and foundational value for brands and enterprises. Yext has also been extremely effective at marketing itself.

However, if it wants to succeed as a public company, with all the corresponding investor expectations, Yext will need to continue to execute aggressively on the core value proposition but also broaden its customer population and build out its platform beyond its current capabilities.