The definitive SEO audit part 3 of 3: Off-site

In the final installment of his three-part series on how to conduct a thorough SEO audit, columnist Dave Davies talks about assessing off-site factors and addressing the issues found therein.

Disclaimer: Every situation is unique. This outline of the elements of an off-site SEO audit discusses the common first points I look at with unpenalized sites when I’m looking to enhance their profiles. If you have a penalty or other serious issues, these points are not exhaustive and will not cover all the areas you will need to research or methods to employ.

Over the past two months, we’ve pieced together an SEO audit strategy with the first two parts of a three-part series. Today, we’ll be completing the series with a look at auditing your off-site SEO.

Regular readers will remember that three months ago, I wrote about performing a manual backlink audit. In that article, we looked at the steps one can use to pull consistent and complete backlink data for a website — but we really didn’t get into what you’re looking for and why, or the many other aspects of off-site SEO that need to be considered. Today, we’re going to do just that.

If you haven’t read the other two parts of this series, you may want to; however, the order isn’t critical. The full series has looked at:

- Technical SEO

- Content (or “on-site”) SEO

- Off-site SEO

So, let’s get to it!

1. Google My Business

We tend to think of a Google My Business listing as a local SEO factor. It is, of course, but it’s also more than that. Anyone who knows me as an SEO writer knows I love entities — that is, I love the idea of entity metrics and calculations by Google.

I won’t get into the full details here, though I did write a piece on the patent Ranking Search Results Based On Entity Metrics back in January for those who care to know more. All that’s important to understand, for our purposes, is that Google takes in signals to determine what things are, what they relate to, and how important/relevant they are. Basically, they want to reduce everything to a value based on what it’s related to.

This is where your Google My Business listing comes in — it is the strongest identifier of you as an entity to Google.

This isn’t just an issue of having a listing, it’s an issue of having a complete listing. Ensure all of the information is complete and that you’ve provided the right category information. I’ll give you a moment while you head over to https://www.google.com/business/ and check.

100vw, 800px” data-lazy-src=”https://searchengineland.com/wp-content/seloads/2016/07/entity-metrics.jpg” /></p>

<h2>2. NAP</h2>

<p>Again, we tend to think of NAP (<strong>N</strong>ame, <strong>A</strong>ddress, <strong>P</strong>hone number) as a local off-site SEO factor, and it is. However, it’s also an entity metric — and an important one at that!</p>

<p>For those unfamiliar with what NAP references, it’s the idea that across all points that refer to an entity’s location, website and contact details, the information should be consistent. If we think about it, if FourSquare references your business at “suite 101” and shows a phone number that begins with 800, but your Google My Business listing uses “#101” and a 250 area code, it’s very possible the connection won’t be as strong in the reinforcing of your business as the entity at that location nor any of the categories, reviews and other attributes that come with it.</p>

<p>There are a many NAP checkers, and while most are selling a service, they do tend to offer a free tool to see how you fare. You can use the tools and then visit the sites with issues and correct them manually, in most cases. A few free tools you can use to check your listings are:</p>

<ul>

<li><a href=) Moz Local

Moz Local

Simply bring everything in line with your Google My Business listing wherever possible.

3. Social media

100vw, 800px” data-lazy-src=”https://searchengineland.com/wp-content/seloads/2016/07/social-media-strategy.jpg” /></p>

<p>I’m not discussing here whether a strong social profile is a direct SEO signal currently, so let’s not head down that path. What we need to think about is:</p>

<ul>

<li>Can a strong social presence help me build other direct SEO signals?</li>

<li>As AI develops, is it likely that aspects of a social profile could bleed into the factors?</li>

</ul>

<p>These are obviously both leading questions, as the answer is undoubtedly a “yes” on both counts. So, knowing we need “strong social profiles,” what does this mean, and how do you do it? There are a number of steps in this process:</p>

<ol>

<li>Take stock of your social profiles. Create an Excel sheet and document your starting point (today) across all the various social networks you have accounts on.</li>

<li>Think realistically about how much time each day you have to dedicate to your social efforts.</li>

<li>Think about which social networks make the most sense for your client demographic. There’s a great breakdown of the demographics and intents across various social networks <a href=) over on the Hootsuite blog from earlier this year. Isolate the ones that make the most sense to your business with the time you have available, and focus there. When in doubt about which social networks to focus on, ask your current customers where they are. (Just remember that this will only include people who are already familiar with your brand. If you want to expand, you may need to go where your current customers aren’t.)

over on the Hootsuite blog from earlier this year. Isolate the ones that make the most sense to your business with the time you have available, and focus there. When in doubt about which social networks to focus on, ask your current customers where they are. (Just remember that this will only include people who are already familiar with your brand. If you want to expand, you may need to go where your current customers aren’t.)

The key to working your social media properties to aid in your SEO efforts is to keep them consistent in messaging and format (think of the NAP from earlier). Further, social networks are a great way to connect with influencers, arrange interviews or offer up content of your own. You just need your imagination, a trustworthy profile and a way to connect with people who can help you (and vice versa), and social media can be a fantastic link building tool.

4. Your backlinks

100vw, 800px” data-lazy-src=”https://searchengineland.com/wp-content/seloads/2016/07/backlink-audit.jpg” /></p>

<p>If there is any doubt as to the continued and arguably strengthening impact links have on rankings, you need only refer to Google’s own comments on <a href=) links being one of the main three ranking factors and a study done by Stone Temple Consulting published on July 20, 2016, that found links may be even more important than previously thought. So with any discussion about their weight set aside, let’s move on to the analysis.

links being one of the main three ranking factors and a study done by Stone Temple Consulting published on July 20, 2016, that found links may be even more important than previously thought. So with any discussion about their weight set aside, let’s move on to the analysis.

There are a variety of core factors you need to review when analyzing backlinks for new opportunities. The tools and methods you can use to pull and view your backlink data are vast. I discussed my own preferred method here, but being that thorough outside a penalty is not critical (though I still do it that way).

What’s important is that you end up with a list of your links and the core data points (below) that can be easily viewed in your preferred format. I prefer spreadsheets. Worth noting, there’s a reason the image above has coffee — before you get started on the process, you might as well get a pot going, because you’ll likely need it.

With the data in hand, you need to review:

- Anchor text. The anchor text used to link to your site is a double-edged sword. If you have no links with keyword-based anchor text, it’s difficult for Google to pass relevancy; too many links with keyword-based anchor text, and it looks like spam. Like keyword density, there is no magic number I can tell you — but when you’re looking through your backlinks sorted by anchor text, it will quickly become clear. If 90 percent of the links to your site have the anchor “blue widgets,” it’s probably too high. On the other hand, if only one percent of your links have it, then it’ll be too low. When you’re reviewing your backlink anchor text, consider what would happen naturally, and target that.

- Links vs. domains. Another metric you’ll need to review is your total links vs. referring domains. If you have 5,000 links coming from 12 domains, that is not going to yield a strong profile. There may be reasons for it, and it may not be penalty-worthy; however, it’s likely not a recipe for success. Like anchor percentages, there is no ideal distribution, and there are legitimate reasons for a variety of ratios. But when you’re comparing your links with your competitors, this is going to be a critical consideration (More on that below).

- Nofollow links. It’s important to understand that nofollow links do not pass PageRank. To be clear, I’m not referring to the green bar Google discontinued last April; I’m referring to the internal PageRank scores that are still alive and well. These links won’t help or hurt you and can safely be removed from consideration. In fact, I often remove the nofollowed links as the first step, simply to make the rest of the filtering easier.

- Where your links are from. Reviewing the domain names and metrics of the sites linking to you is important — not just to get a feel for whether you have bad links, but to understand your own strengths. Links from strong sites with high relevancy are obviously worth more than links from weaker sites or sites with little relevancy. A link to the fictional SELwidgets.com site from a blue widget manufacturer would be far more valuable tham a link from a generic directory, or even a link in a manufacturing forum on a single thread discussing blue widgets. I generally recommend ordering your link list first by domains and scanning through those, moving any “known good” to a different tab/spreadsheet or otherwise marking them. The next stage is to order the list by key domain metrics. The metrics you have access to will vary by the tool you use, and none are perfect. Whether you’re using Moz with their Domain Authority or Majestic with their Trust Flow, you can use this as a general guide. This is not to say every link from a site or page with a high rating is good, but the higher the rating from a trusted tool, the less suspicious you need to be.

- Social shares. If the tool you’re using provides social share data (one of the reasons I like Ahrefs), this can add to the value and legitimacy of the link.

- Outbound links. If the tool you use also provides the page outbound link counts, that’s a key piece of data when possible. If you export your backlinks in Ahrefs, it will include the number of internal and external links on the linking page. You can use this as a consideration when looking for spam. Additionally, it’s important to note that the more links there are on a page, the less value each one has. You need to take this into account when you’re considering the amount of weight you are getting from your backlinks.

- Redirects. A final aspect of links I like to consider when looking at bulk link data is the number of links that are redirects. A 301 redirect does pass link juice to the new URL, but a bit of weight is stripped off in the process. This is fine, as a bit of juice is lost in the passing of PageRank through a link as well; however, what has never been answered to the best of my knowledge is whether the loss of PageRank is multiplied through chained redirects. I suspect that chained redirects may amplify the PageRank loss; this may not be the case, but when developing a strategy, it’s always better to assume the worst. For anyone who may be interested in Matt Cutts’ explanation of PageRank dissipation via links and 301s, you can watch here.

So, now you have a solid idea of what your own backlink profile looks like. There are a variety of ways to sort the links into useful groupings. I generally make tabs in a spreadsheet, grading them from 1 to 5, and only look at the links between grades 3 and 5 when considering the weight of the site I’m working on.

Before we can do this, however, we need to put things into perspective. A backlink I would grade a 5 when working for a local realtor, but I may grade a 2 or 3 in a higher competition sector or national battle. Which brings us to…

5. Your competitors

Knowing the strength of your site is great, but without context, it’s essentially worthless. What we need to know is what you’re up against.

To get a very quick overview, I like to turn to Majestic, though Ahrefs has a comparable tool. Essentially, you can enter a few competitors into the system, and it will give you a generic view of their backlinks.

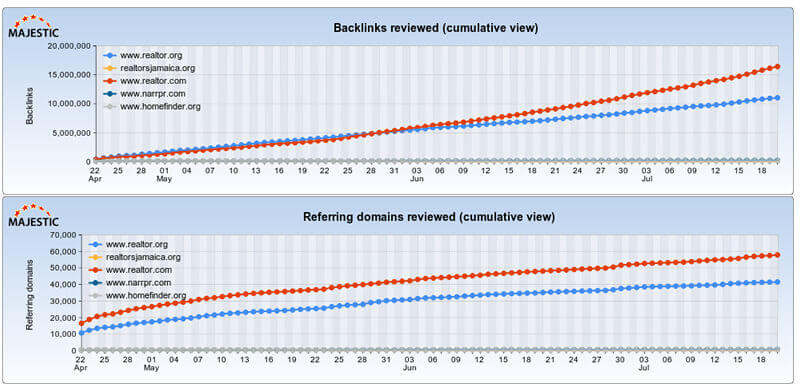

A picture being worth a thousand words, let’s just take a peek at what I mean. Let’s assume I want to go toe-to-toe in the national real estate market, and I’m Homefinder.org. I would enter my domain and four of the top competitors into the tool and get the following:

This certainly doesn’t look promising. There are a few competitors in the range of links we have, but it’s definitely a massive uphill battle. This can happen in a lot of competitions, but let’s also notice that there are sites ranking that aren’t in the tens of thousands of links. If we remove the top two, we’re left with:

What we can quickly see here is who is winning by brute force and who is winning with a link volume we can reasonably approach in a realistic period of time. With this in mind, we’ll then conduct the same research we did for our own site, but for the competitors. This will give us a feel for what they’re doing and how strong they are. Pulling all their backlinks into the same spreadsheets will not only assist you in understanding the weight their links are carrying but also illustrate where they’re getting them.

I will save competitor-based backlink building for a future article; however, the purpose of auditing your backlinks and those of your competitors is to understand the weight advantage they have and the link profiles that are beating you.

The interesting thing about links is that they have to be treated quantitatively, as opposed to content which is more qualitative. We have metrics and numbers; we need to do what they did and then add 10 percent if we want to win.

With the gap in link weight established, one final area you need to be cognizant of is how long it will take to get there, which leads to the final stage of the competitor auditing process: link growth. If we move to the historical index, we get the following:

100vw, 800px” data-lazy-src=”https://searchengineland.com/wp-content/seloads/2016/07/realtors-link-growth.jpg” /></p>

<p>I’ve omitted the biggest players here, as it makes the data almost unreadable for our purposes. But with just these two competitors, we can see that www.narrpr.com is building aggressively and has been for some time. We see they’re acquiring links at thousands per month coming from dozens or hundreds of unique domains. We need to take this into account as we set our strategies.</p>

<p>To know what we need to accomplish to surpass them, we need to consider both the links they have previously built <em>and</em> the number of links they’re currently acquiring. If the goal is to be stronger than www.narrpr.com (and assuming the links we’re developing are of equal quality), then we’ll need to allocate enough resources to catch up, surpass and then add to that the link volume they’re building each month.</p>

<h2>Conclusion</h2>

<p>We’re now armed with a strong understanding of our off-site SEO efforts — both where we are currently and how we compare to our competitors. This sets us up to understand what we need to do and a bit about how to do it. From this point, the only thing left to do is to get it done.</p>

<p>It’s time to start ensuring that your business listings are in order; that your social profiles are not just great for your visitors but coordinated and ready to utilize in link strategies; and that you can plan out how to bridge the gap between where you are relative to your competitors and where you need to be to beat them. Unless you’re in the lowest competition sector, it’ll take time. But all good things do.</p>

</div>

</div>

</article>

</div><!-- #content -->

<ul class=)